Paycheck tax calculator georgia

The Ad Valorem calculator can also estimate the tax due if you transfer your vehicle to Georgia from another state. The information provided by the Paycheck Calculator provides general information regarding the calculation of taxes on wages for Georgia residents only.

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download

Georgia Hourly Paycheck Calculator.

. Our income tax calculator calculates your federal state and local taxes based on several key inputs. Make Your Payroll Effortless and Focus on What really Matters. Georgia State Tax Calculator.

To begin with federal income is taxed at 1227 percent while state income is taxed at 462 percent. The amount of property taxes you pay in Georgia depends on the assessed value of your home which is based on but not equal to your homes market value. Those that are filing as single see tax rates that range from 1 to 575.

If you make 95500 in Georgia what will your paycheck after tax be. Calculating your Georgia state income tax is similar to the steps we listed on our Federal paycheck calculator. Yes as Georgia does not tax Social Security and provides a deduction of 65000 per person on all types of retirement income for anyone age 65 and older.

For 2022 tax year. The Georgia Salary Calculator is a good calculator for calculating your total salary deductions each year this includes Federal Income Tax Rates and Thresholds in 2022 and Georgia State. Ad This is the newest place to search delivering top results from across the web.

The results are broken up into three sections. Ad Compare Prices Find the Best Rates for Payroll Services. Georgia Hourly Paycheck Calculator Results.

Your household income location filing status and number of personal exemptions. We use the most recent and accurate information. Employers have to pay a matching 145 of Medicare tax but only the.

Georgia Salary Paycheck Calculator. This Georgia bonus tax calculator uses supplemental tax rates to calculate withholding on special wage payments such as bonuses. If you make 70000 a year living in the region of Georgia USA you will be taxed 11993.

Find a List of State Tax Calculators and Estimates for Tax Year 2021 and 2022. For 2022 the minimum wage in Georgia is 725 per hour. Below are your Georgia salary paycheck results.

Hourly employees who work more than 40 hours per week are paid at 15 times the regular pay rate. If youre age 62 to 64 this. Ad Get the Paycheck Tools your competitors are already using - Start Now.

These calculators should not be relied upon for. So the tax year 2022 will start from July 01 2021 to June 30 2022. Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local W4 information.

This calculator can estimate the tax due when you buy a vehicle. Secondly FICA and state. Taxable Income USD Tax Rate.

Content updated daily for ga payroll calculator. Georgia Income Tax Calculator 2021. Use ADPs Georgia Paycheck Calculator to estimate net or take home pay for either hourly or salaried employees.

The tax brackets are different depending on your filing status. Calculate your Georgia net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4. Choose Your Paycheck Tools from the Premier Resource for Businesses.

Estimate Your State and Federal Taxes. To determine assessed value. Create professional looking paystubs.

Use the Georgia bonus tax calculator to determine how much tax will be withheld from your bonus payment using the aggregate method. It is not a substitute for the advice of. Paycheck Results is your gross pay and specific.

Ad In a few easy steps you can create your own paystubs and have them sent to your email. To use our Georgia Salary Tax Calculator all you have to do is enter the necessary details and click on the Calculate button. For any wages above 200000 there is an Additional Medicare Tax of 09 which brings the rate to 235.

After a few seconds you will be provided with a full breakdown. The first thing you need to know. Your average tax rate is 1198 and your marginal tax rate is.

Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes. Lets go through your gross salary in further depth. Just enter the wages tax withholdings and other information required.

Paycheck Calculator Take Home Pay Calculator

Paycheck Calculator Take Home Pay Calculator

Georgia Paycheck Calculator Smartasset

Free Tax Resources Tools And Tips To Simplify Tax Season Lili Banking

Find The Right Way To Plan Your Taxes Forbes Advisor

Income Tax Calculator Estimate Your Refund In Seconds For Free

.jpg)

Income Tax Calculator Estimate Your Refund In Seconds For Free

How To Calculate Foreigner S Income Tax In China China Admissions

How To Calculate Federal Income Taxes Social Security Medicare Included Youtube

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download

Free Georgia Payroll Calculator 2022 Ga Tax Rates Onpay

Tax Calculation Spreadsheet Spreadsheet Spreadsheet Template Business Tax

Free Online Paycheck Calculator Calculate Take Home Pay 2022

7 Steps To Buying A Second Home Re Max Of Ga Remaxga Homebuyer Secondhome Vacationhome Home Buying Process Buying First Home Home Buying Tips

80 000 Income Tax Calculator New York Salary After Taxes Income Tax Payroll Taxes Salary

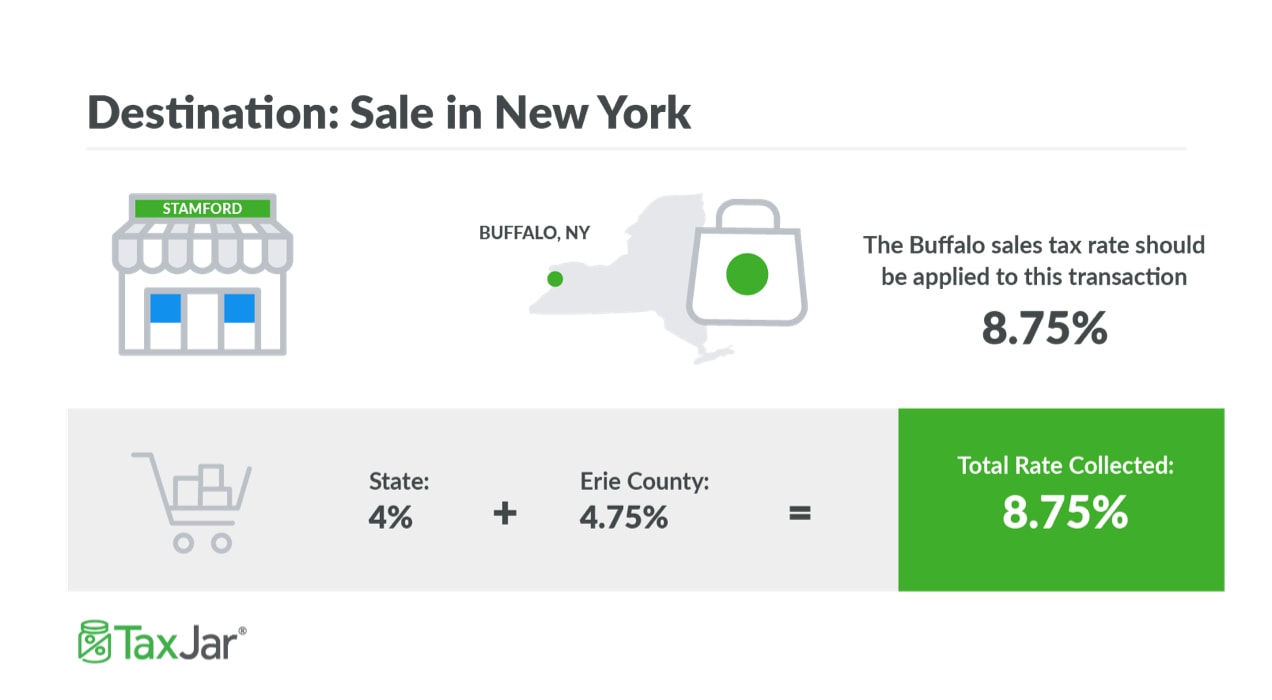

How To Charge Your Customers The Correct Sales Tax Rates

Free Employer Payroll Calculator And 2022 Tax Rates Onpay